32+ mortgage interest tax write off

Web The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt incurred after Dec. Ask a Tax Expert for Info Now About How to Write-Off Mortgage Interest in a Private Chat.

Economist S View Yet Again Tax Cuts Do Not Pay For Themselves

Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million.

. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. State and local real property taxes are. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web If the home was acquired after December 15 2017 the home acquisition debt limit is 750000. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Taxes Can Be Complex.

If say your co-owner pays 75 percent of the. Web You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage to buy the property or to improve it. Web Is mortgage insurance tax-deductible.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. 16 2017 then its tax-deductible on mortgages. Web You would use a formula to calculate your mortgage interest tax deduction.

The first is that you must itemize your taxes and that means not taking the. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Or 375000 if married filing separately.

You only get a tax deduction for mortgage interest youve personally paid. Web Mortgage Interest Write-Off Explained. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web Most homeowners can deduct all of their mortgage interest. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

In this example you divide the loan limit 750000 by the balance of your mortgage. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

Ad Chat Online Right Now with a Tax Expert and Get Info About Tax-Deductible Donations. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Also you can deduct the points. Taxes Can Be Complex. Web There are a few stipulations you must meet to write off your mortgage interest on your taxes.

Web IRS TAX TIP 2003-32 REFINANCING YOUR HOME Taxpayers who refinanced their homes may be eligible to deduct some costs associated with their loans according to the IRS. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

How You Can Create A Passive Full Time Income In 90 Days Or Less By

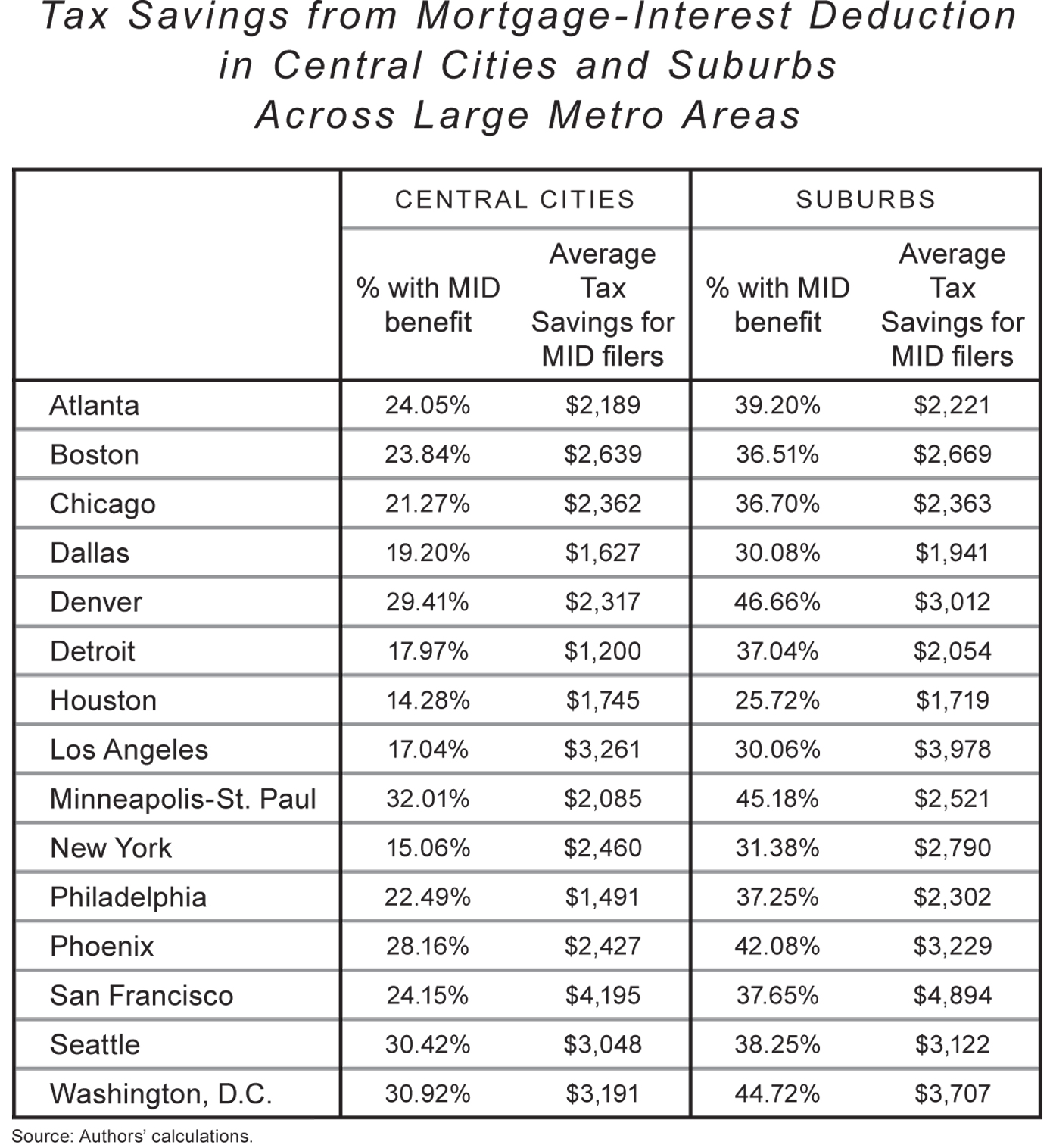

Rethinking Tax Benefits For Home Owners National Affairs

Media Continues To Misreport Unemployment 31 8 Million People On State Federal Unemployment Insurance Week 18 Of U S Labor Market Collapse Wolf Street

Economist S View A Gas Tax With A Rebate

Is The Interest On Your Mortgage Tax Deductible In Canada Loans Canada

Ex99x2 007 Jpg

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

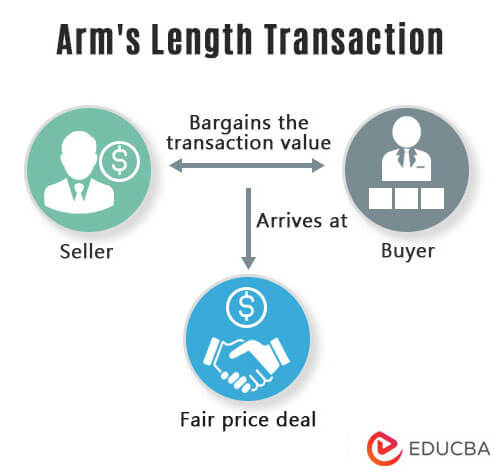

Arm S Length Transaction Characteristics Examples Transfer Pricing

Mortgage Interest Deduction A 2022 Guide Credible

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Is Mortgage Interest Tax Deductible Accumulating Money

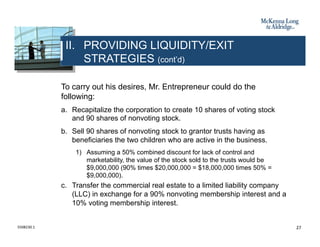

Business Succession Planning And Exit Strategies For The Closely Held

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Ex99 1 031 Jpg

Mortgage Interest Deduction Bankrate

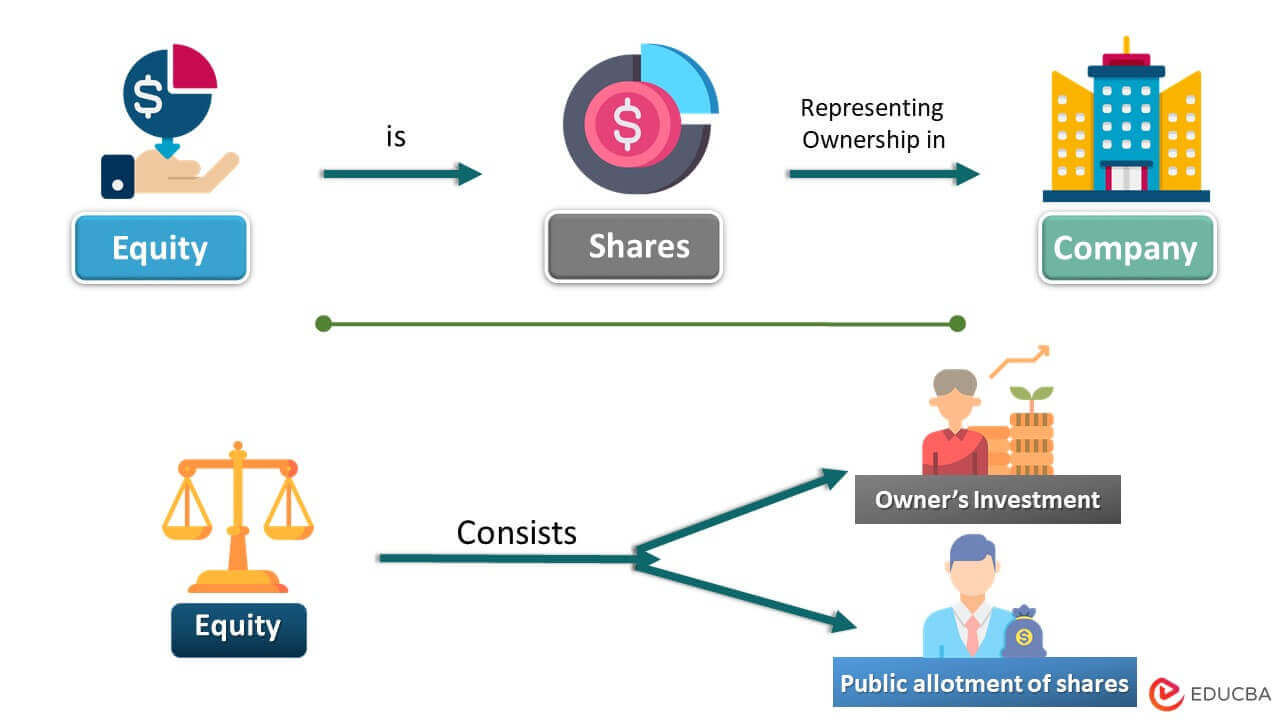

Equity Meaning Formula Examples Calculation Importance

Xu Biweekly Issue 44 3 December 2022 By Xu Magazine Issuu