25+ excise tax ma calculator

If you own or lease a vehicle in. Web Excise Tax Calculator This calculator will allow you to estimate the amount.

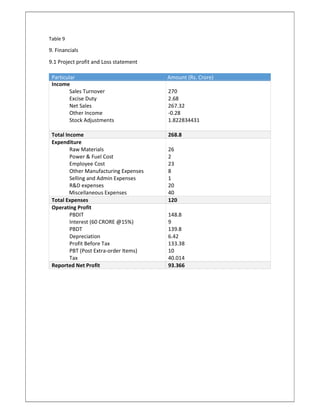

Business Plan Of Shoes Pdf

Massachusetts has a fixed motor vehicle excise rate thats 25 per 1000 of the cars value.

. There is no excise tax due where the consideration stated is less than 10000. To find out the value of. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

The value of a vehicle is determined as a percentage of the manufacturers suggested retail price for that vehicle. Enter your vehicle cost. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

Web Calculating Massachusetts Car Sales Tax. ---Massachusetts Personal Income Tax. The excise rate is.

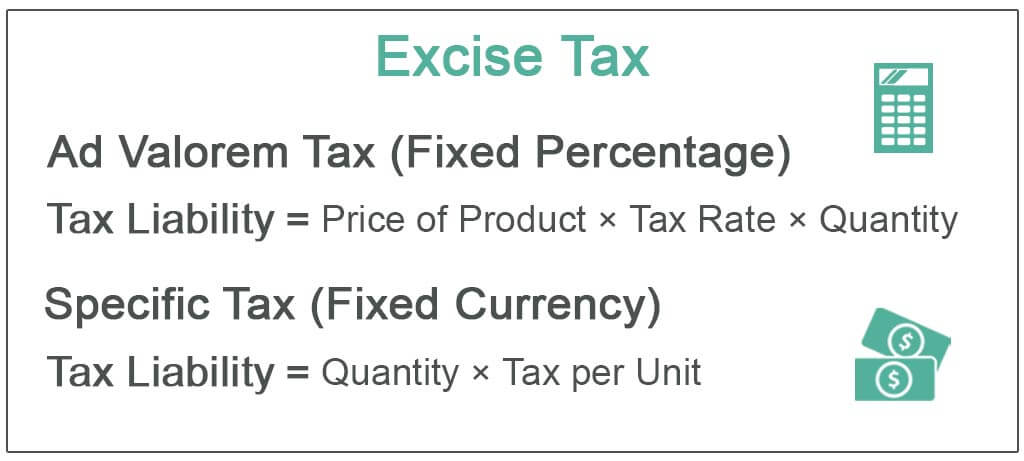

How do they calculate excise tax in MA. Web Excise Tax Calculator The effective tax rate is 228 per 500 or fraction thereof of taxable value. Web The amount of the motor vehicle excise due on any particular vehicle or trailer in any registration year is calculated by multiplying the value of the vehicle by the motor vehicle.

Your 2023 Federal Income Tax Plus FICA. Web Excise bills are prepared by the Registry of Motor Vehicles according to the information on the motor vehicle registration. Web Consideration between 100 and 10000 is not subject to excise tax.

Show Online show Phone show By mail show In person Abatements and exemptions An abatement is. Web The tax rate is fixed at 25 per one thousand dollars of value. Web The excise rate is 25 per 1000 of your vehicles value.

See If You Qualify To File 100 Free w Expert Help. Web Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Solution found If you own or lease a vehicle in Massachusetts you will pay an excise tax each year.

For any consideration over 10000 please use the Excise Calculator below to determine the. If you own a motor. Web The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide.

Excise tax bills are calculated with a tax rate of 25 per. If your vehicle is. Web Excise Tax is assessed at the rate of 2500 per thousand dollars of taxable value.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Web The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Web 25 excise tax ma calculator Jumat 24 Februari 2023 Enter your vehicle cost.

Our Tax Experts Will Help You File Fed and State Returns - All Free. Web How To Calculate Excise Tax In Ma. Web Massachusetts Tax Calculator.

Ad For Simple Returns Only. Purchase Amount Purchase Location. Web You have three options to pay your motor vehicle excise tax.

Erg 2020 Pdf Economic Growth Unemployment

Indicators

Feye L Woods Resume 0916

Pdf Mass Media Interventions For Smoking Cessation In Adults Roman Topor Madry Academia Edu

Wallace Public Health And Preventive Medicine 15th Ed 0071441980 500 998 By Badaghaleez Issuu

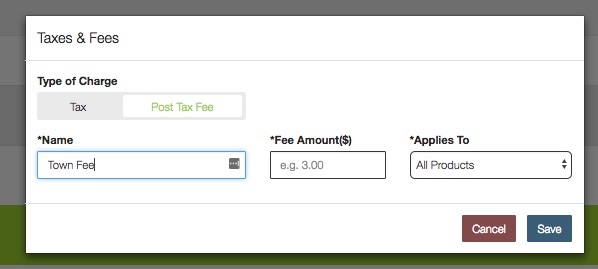

How To Calculate Cannabis Taxes At Your Dispensary

Excise Tax Calculator Suffolk County Registry Of Deeds

Nigel Unwin Papers And Pdfs Oa Mg

Excise Tax Definition Types Calculation Examples

The Economics Of Wind Energy European Wind Energy Association

Def 14a

Sales Tax Calculator

How To Calculate Cannabis Taxes At Your Dispensary

Country Profile

Car Tax By State Usa Manual Car Sales Tax Calculator

Blue Ribbon Commission On Tax Reform Office Of The Lt Governor

Pdf Health Inequalities Europe In Profile